Warren Buffett, the father of value investing and one of the most successful investors in the stock market, is known for the way he made a fortune from his investments.

He analysed the companies that had excellent growth potential and invested in their individual stocks, irrespective of the general market trends. But apart from this, the one thing he has always promoted is the allocation of some of your investment corpus to index funds. In fact, while advising his wife, he suggested she invest 90% of her money in index funds.

One thing that can be concluded from this is that both investing in individual stocks and index funds, however different, is beneficial. The choice depends on your risk appetite and financial goals. To understand how you can decide between the two, let us explore both options in detail.

Investing in individual stocks

Investing in individual stocks allows you to buy or sell stocks from the stock exchanges using your Demat account and a trading account set up with a SEBI-registered broker, such as Motilal Oswal. You can select the number of shares you want to invest in and manage your preferences accordingly. It also gives you greater control over your portfolio.

When you invest in stocks of a particular company, you become part-owner of the company. You are entitled to the dividends that the company might declare from time to time. Moreover, you might also get voting rights by virtue of your stock ownership.

You earn profits when you buy low and sell high. Also, if the company declares bonus shares or makes a rights issue, you stand to benefit.

However, stocks are very volatile and picking the right stocks involves extensive research and understanding of the ways of the market. Factors influencing stock prices are also far too many, and the risks involved are at par with the profit opportunity that the equity segment provides.

Investing in index funds

Index funds are a type of mutual fund – they provide a basket of stocks to invest in. They are a readymade portfolio created by fund managers that mirror a benchmark index. This means the investment in each stock would be in the same proportion as it is in the index.

For instance, the Nifty 50 index fund would invest in the 50 stocks listed on the Nifty 50 index in the exact same proportion as they appear on the index. The fund manager ensures it is always aligned. Index funds track the performance of the underlying index— the Nifty 50, in the case of our example. When the index moves upwards as a result of the underlying securities gaining market value, the NAV of the index fund increases proportionately. You get a profit when you redeem your units at a higher NAV compared to the NAV at which you invested. Moreover, you can earn dividends if you choose the dividend option when investing in the index fund, like with other mutual funds.

One essential point to note here is that index funds only mirror the index and are not programmed to overtake or outperform the index. Your profits will remain in line or at par with market growth.

That said, the direction of indices in the long-term is always upward. That is the allure of index funds for the long term, albeit slower growth compared with direct investing in select individual stocks.

Now that we understand how both investment avenues, individual stocks and index funds work, let us compare the two options side by side.

Individual stocks v/s index funds – similarities and differences

Here’s a comparative analysis of investing in stocks v/s investing in index funds. Let us start by analysing how the two are similar in nature.

Similarities:

- Both involve investing in the equity market.

- Both stocks and index funds are listed on the stock exchange.

- The tax treatment of both these options is the same. There is no tax benefit on investment. On redemption, however, you attract capital gains tax. If you hold your investment for less than 12 months, the gains are taxed at 15% and are considered short-term capital gains. On the other hand, if you hold your stocks for 12 months or more, the gains are called long-term capital gains. Such gains are tax-free up to Rs.1 lakh. If, however, they exceed Rs.1 lakh, the excess is taxed at 10%.

- Dividends, if any, earned from these avenues are paid out to the investor but taxed at your income tax slab rates.

- Both avenues have a high-risk profile since they invest in equity.

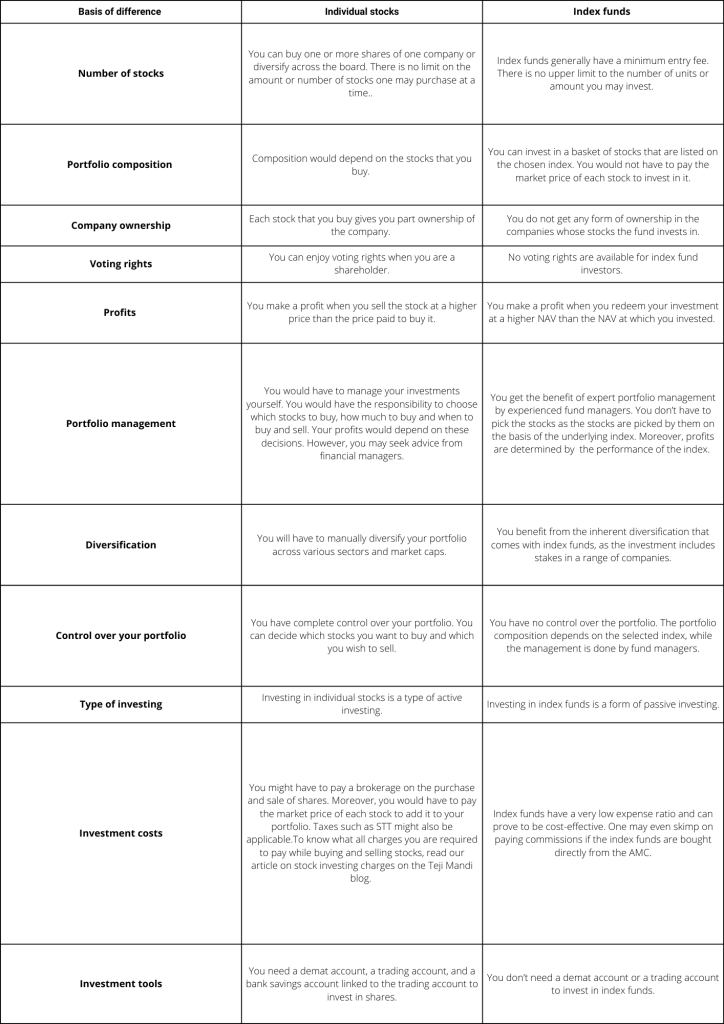

Let us now understand the differences between individual stocks and index funds by comparing them side by side.

With this, the similarities, as well as the differences between the two, must be very clear to you. However, an investment decision is better taken when you analyse the pros and cons of each option.

Individual stocks v/s index funds – pros and cons

Let’s look at the pros and cons of investing in each of these avenues.

Based on the analysis above, the question of choosing the most suitable option for you arises. Let us try to solve this dilemma.

Which one should you pick – Index funds or individual stocks?

Well, the answer is investor-specific. Some investors prefer investing in individual stocks though they are going to need to put in time and effort to monitor the markets, while some opt for index funds though they know an outperformance is not possible. It is like choosing between a la carte and a buffet at a restaurant. Some prefer the former while others the latter depending on how confident they are about a particular dish, how much they want to eat and which one would be cost-effective.

But the fact remains the same– both options have their respective merits and demerits. It, therefore, boils down to what suits your investment needs.

You can choose to invest in individual stocks if:

- You are a seasoned stock market investor and want to create your own portfolio.

- You can track the market movements continuously to benefit from short-term volatility.

- You want complete control over your portfolio.

- You want to employ different stock trading strategies for maximum gains.

- You want to invest in stocks belonging to different indices.

- You have the appropriate risk appetite and tolerance to stomach the volatility of stocks.

On the other hand, investing in index funds can prove fruitful if:

- You are a new investor and do not want to risk investing all of your savings in one or two stocks.

- You do not understand the stock market very well and want a readymade portfolio.

- You do not want to shoulder the risk of individual stock investing.

- You want to diversify your portfolio with ease.

- You cannot track the stock market minutely and are satisfied with tracking the movements of an index as a whole.

- Your risk profile is restrictive, but you still want to explore the equity segment.

To understand the details of portfolio diversification, read our blog on stock investing in India – what is diversification of portfolio here.

So, assess your investment needs and preferences and then choose the right option. Know the merits and demerits of both options so that you can make an informed choice. Here are some investment tips to keep in mind:

- Invest in these avenues only if you have the risk appetite of facing short-term market volatilities.

- Have a long-term investment perspective so that you can enjoy attractive returns.

- When redeeming, keep the tax treatment in mind to plan your taxes effectively.

In conclusion

Investing is an art, and when you are investing in equity, you need the skill to face the risks and earn returns. Both these investment avenues – index funds as well as individual stocks – can help you earn returns but only when you choose right. So, be an informed investor and pick the right mode of investing in equity suitable to your risk profile.

You don’t need to go on investing on your own. The experts at Teji Mandi are trusted by more than 10,000 investors for portfolio management and are with you every step of the way. In return for your trust, allow us to extend our best services and render active investing advice to you. Reach out to us through our website today!